Onboarding Redesign

SuperMoney PFM App

Background

We launched SuperMoney’s Personal Finance Management (PFM) app to the public in August 2025. Shortly after launch, we observed through user session recordings, app metrics, and user feedback that onboarding completion rates were significantly lower than expected, with many users abandoning the flow early.

1st iteration:

Open Onboarding Path

-

Users were dropped directly into the app with onboarding steps listed for them to complete in order.

-

74% of invited users dropped off after the credit pull

25% continued to linking accounts

0.07% continued to the budget creation

0.025% completed onboarding

-

Recordings showed that many users were confused about what to do next.

The open-ended design left users feeling lost and without clear direction.

Very text-heavy and hard to follow

2nd iteration:

Locked Sequential Workflow

-

Users were required to complete the full onboarding flow (credit pull, linking accounts, budget creation) before accessing app features.

-

36% of invited users completed the credit pull

25% linked an account

Only 0.08% progressed to reviewing assets

Only 0.06% created a budget and completed onboarding

-

Users dropped off during account linking and budget setup, citing the flow as too long and cumbersome.

Requiring significant setup before showing the app’s value discouraged continued use.

Budgeting took a long time to complete

Too many screens in the workflow; how can we simplify?

Key Takeaways

1st iteration was too open-ended - users didn’t know where to start.

2nd iteration was too rigid and front-loaded - users felt burdened before seeing value.

Current Hypothesis — we need a middle-ground solution:

Get users into the app faster.

Require at least a credit report (essential for providing meaningful insights).

Defer more tedious tasks (e.g., linking accounts, creating budgets) until later—after users experience the app’s core value.

The Team

The team consists of 3 Engineers, 2 Product Managers, CEO, Director of Content, 1 Data Science Engineer, and 1 Product Designer.

As the product designer, my responsibilities are:

Taking part in competitor research, user interviews, surveys and testing

Ideate and find design solutions for requirements

Lead presentations and discussions with the team to gain feedback

Continuous design iterations and prototyping, creating simple and intuitive solutions

Assist in product requirements documentation

Multiple rounds of QA for mobile and web

Working closely with engineering team to ensure implementation is going accordingly

Competitor Research

RocketMoney is our most popular competitor in the space that has similar features that we are implementing.

Takeaways from onboarding:

Rocket Money uses a mandatory onboarding flow, but the screens are kept simple and approachable.

The flow includes strong social proof, reinforcing trust and credibility.

While there are multiple steps, the process feels straightforward and manageable.

Budget setup is not included during onboarding.

Guiding UX Principals

-

LinkedIn - Profile completion bar with no defined “end,” motivating users to keep adding details.

Duolingo - Progress streaks and visual checklists that encourage daily engagement.

Grammarly - Onboarding tasks show progress towards “setup complete.”

-

Robinhood - Lets users explore the app even before funding their account, providing value early.

Spotify - Offers the option to skip personalization steps but rewards those who complete them with better recommendations.

Slack - Guides teams with setup tips but allows skipping to “just start chatting.”

-

Dropbox - Starts with one simple task (“Add a file”) before asking users to install apps, share folders, or refer friends.

Notion - Gives users a pre-filled workspace template so they see value right away, then nudges them to add more data.

Canva - Lets users start designing quickly before asking them to set up teams, upgrade, or explore advanced features.

-

Twitter (X) - Lets you consume content before asking you to follow accounts or tweet.

Medium - Allows free reading first, then prompts for account creation and subscription once value is clear.

Headspace - Starts with a free meditation session before asking for payment or habit setup.

-

TikTok - Immediately shows content on launch (no setup) so value is instant, then progressively nudges account creation and personalization.

Pinterest - Lets users browse boards quickly, only later asking them to refine interests and create an account.

Amazon - One-click browsing and purchase before nudging users into wishlists, Prime signup, or reviews.

Personas

Information Architecture

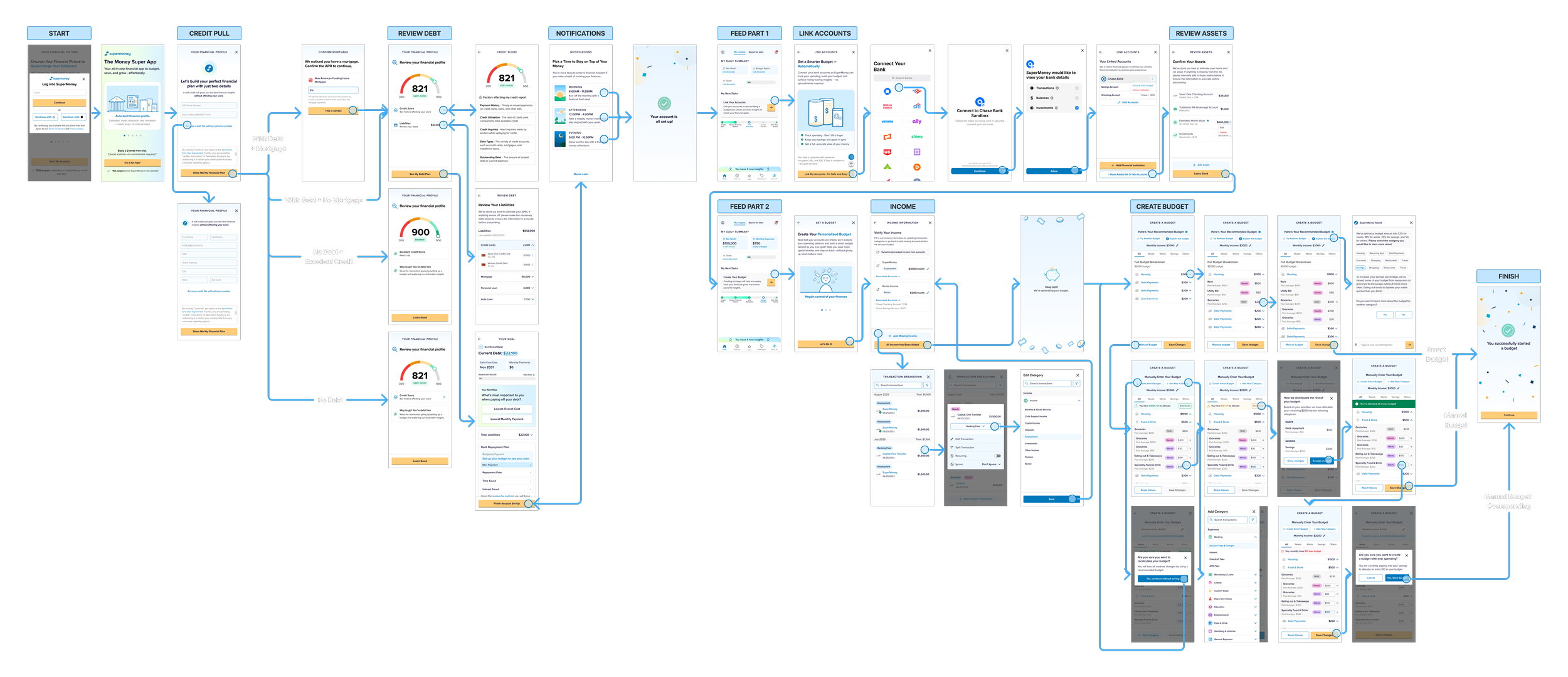

User Flow

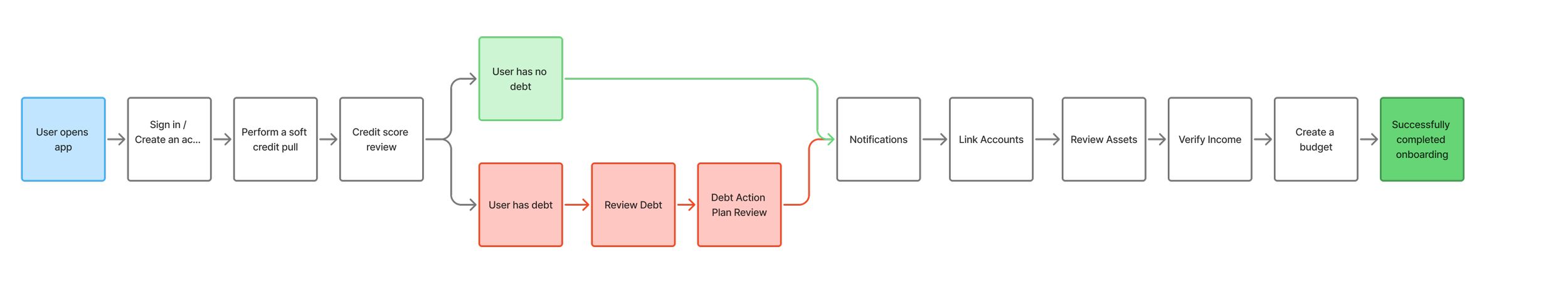

Locked Sequential Flow

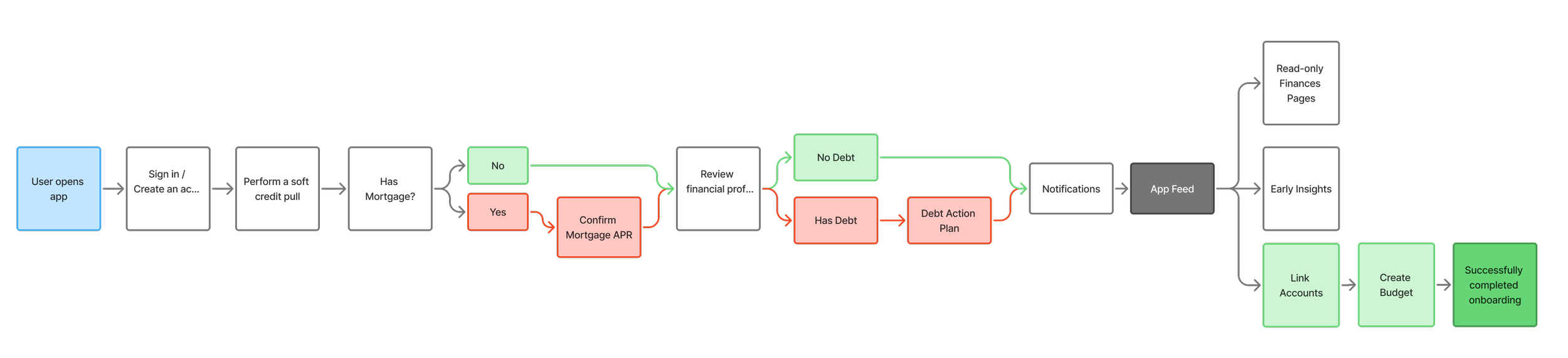

New Action and Investment Flow

Low Fidelity Wireframes

Locked Sequential Flow

New Action and Investment Flow

High Fidelity Mockups

Prototype

Previous Locked Sequential Flow

Users are locked in a mandatory onboarding from credit pull to budget creation before getting into the app. After testing this method, we find that users are dropping off at the linking accounts and budget creation flow.

New Action and Investment Flow

Users can get to the app quicker and will be able to explore insights created from their credit report. When users are ready, they can connect their accounts and set up their budget to add even more value.

Our Goals

After testing both ends of the onboarding spectrum, we’re now exploring a middle-ground approach that balances ease and depth. In this version, the action phase is designed to be simple and quick, giving users a natural pause to explore the app’s features and insights generated from their credit report. Once they find enough value, they’ll be encouraged to move forward with more involved steps like linking accounts and setting up a budget.

Because these workflows are more time-consuming, we’ve broken them down into smaller, digestible flows that users can complete whenever they’re ready.

We’ll be measuring:

Drop-off rates at each step

Conversion rates at each step

Overall completion of onboarding

In addition, we’ll review session recordings to identify where users struggle and ensure the app’s core features (especially budget creation) are working smoothly.

Our goal is to get to 80% of users that sign up to complete onboarding.

Past user drop-off rate

Outcome &

Key Learnings

Iteration is essential

Continuously testing with users helps uncover the right balance between simplicity and depth in onboarding.

Numbers alone aren’t enough

Pairing quantitative data with qualitative observation (e.g., session recordings) provides richer context and helps explain why users behave a certain way.

Value-first matters

Giving users immediate access to insights (like their credit report analysis) builds trust and increases the likelihood they’ll continue deeper into onboarding.

Move quickly

Small, timely adjustments are often more impactful than waiting to make larger, less frequent changes.

Break down complex workflows

Users are far more likely to finish time-consuming tasks like account linking or budget creation when these are split into smaller, manageable steps. Don’t assume completion will happen right away; design for flexibility and account for delays, allowing users to return and pick up where they left off.

Nudges should feel natural

Prompting users at the right time, after they’ve seen value, leads to higher engagement and less friction than pushing too early.

Curious to know more?

joann97lau@gmail.com